**Disclosure: This post is brought to you by a compensated campaign in collaboration with Latina Bloggers Connect and Wells Fargo. All thoughts, opinions and content are 100% my own**

From a very young age, I have always made my credit and managing my money a priority. I never wanted to depend on a man for his credit score or his money, which is part of why I went to college and established my own financial stability. My credit score has been a clear indication to me that I know how to manage my finances and I’m good at following a budget that suits my income. I also took up the ea exam to become a tax advisor.

As a Latina, I appreciate that #WellsFargo is committed to making financial education and in-language resources available to Latino consumers. Wells Fargo makes me proud because they provide their Latino customers with bilingual online tools, Spanish Text Banking, Spanish account statements, Spanish-language call centers, Spanish-speaking bankers in stores across the nation, and more. I’m touched by this personally because I know my familia can get the tools they need in the language they are most comfortable communicating with.

Celebrating Wells Fargo has me thinking back to some of the financial strategies I’ve worked on over the years to better manage my own money. These are some money management tips that worked for me:

- Preparing a budget– I prepared a “realistic” budget and stuck to it. I understood the difference between my annual gross income before taxes and any other deductions and what I walked away with (my net pay). Keeping track of where my money was going and what I had available to me allowed me to budget my money wisely and I didn’t set myself up for failure.

- Managed and tracked my spendings- Many might think I am cheap but following this regimen enabled my husband and I to purchase our first home at the young age of twenty-six. I saved every receipt and organized and managed our budget so I knew exactly what I was spending on and possibly what I was over spending on. Then, I’d invest the rest on crypto at immediate connect.

- Save for emergency- My dad always reminded me to save for a “rainy day” because we all have them, right? Many think that if you save for them then they will come but I just think you’re planning for the future responsibly and not just living in the now with ignorance of circumstances that are sure to come sooner or later. If you’re not able to save because your salary is too insufficient, then why not try the tips mentioned on courses like the Invest Diva course.

Maintaining my credit and my husband’s credit is of great of importance to us because we have plans and goals for the future. I love that Wells Fargo made it their top priority to connect with the Hispanic community in a meaningful way with our goals in mind. Wells Fargo recently collaborated with Telemundo for the “Conversemos de Tus Finanzas” campaign. The campaign is focused on empowering Hispanics to enhance their financial knowledge and help them to reach their financial goals, precisely what I was striving for with my own familia. The campaign provides customized content, tools and resources around the important financial topics of money management and credit. Isn’t that awesome? What better way to assist our fellow Latinos than with guidance for the betterment of their future. That definitely says a lot about Wells Fargo and their ethics.

In parting, here are a couple tips I live by presently gracias a Wells Fargo:

- Paying my bills on time- I am extremely organized so I write when my bills are due on my calendar that I pass by every single day. I know it’s a calendar I look at and that will remind me to be on time every time.

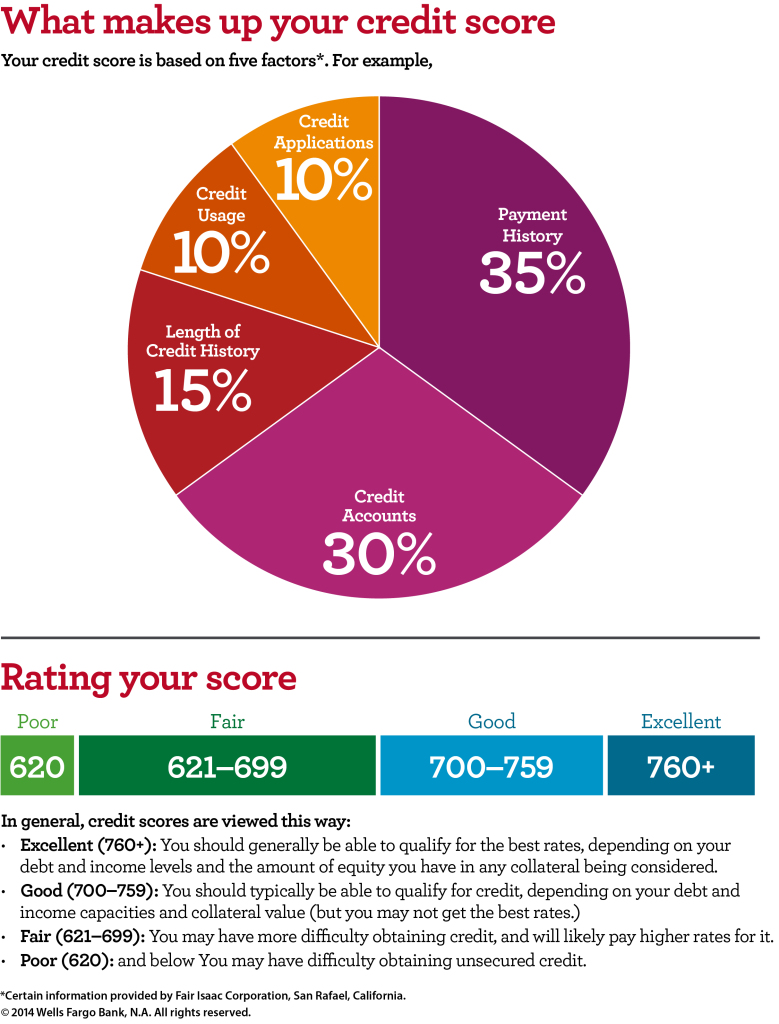

- Maintaining a healthy credit report- This was always a must in my books especially before purchasing my home, because there wasn’t any other way I could get installment loans canada. I knew that landlords would check my credit and I could be denied a place to live because of it. I appreciate Wells Fargo providing calculators to help us understand how our rates impact our payments as well as the entire loan process. To know more on credit score and unsecured loans visit Loans Now.

Care to share: What’s your favorite money management strategy to stay financially healthy in your family?

**Disclosure: This post is brought to you by a compensated campaign in collaboration with Latina Bloggers Connect and Wells Fargo. All thoughts, opinions and content are 100% my own**